Throughout 2022, there have been extensive fraudulent letters being mailed to US taxpayers that appear to be from the Internal Revenue Service. These letters may look legitimate to your average taxpayers who are not experienced with the formatting of an official correspondence letter from the IRS. Many versions of these fraudulent letters are circulating, but a professional tax preparer should be able to identify the clear errors within these letters. Please read the following tips and take a look below at some of the fraudulent letters my clients have received.

Key tips:

- If you receive any letters that have the IRS logo or claim to be from the Internal Revenue Service or US Department of Treasury, always reach out to a professional tax preparer or CPA before responding to the letter.

- NEVER give out your social security number over the phone. The IRS has multiple ways of identifying you as the correct taxpayer without asking you for your full social security number.

- If you call a number listed on an official IRS letter, you will ALWAYS hear an automated welcome recording from the Internal Revenue Service that places you in a queue and asks for many phone prompts before you ever talk with an IRS agent. You are usually on hold for 30 minutes to an hour or longer on average. If you speak with an individual immediately upon calling a number in a fraudulent letter, this should be your first sign to hang up and not give any personal information.

- IRS agents always provide their name and IRS agent ID when they are first connected with a taxpayer over the phone. It is good practice to write this information down in case you need to escalate your inquiry.

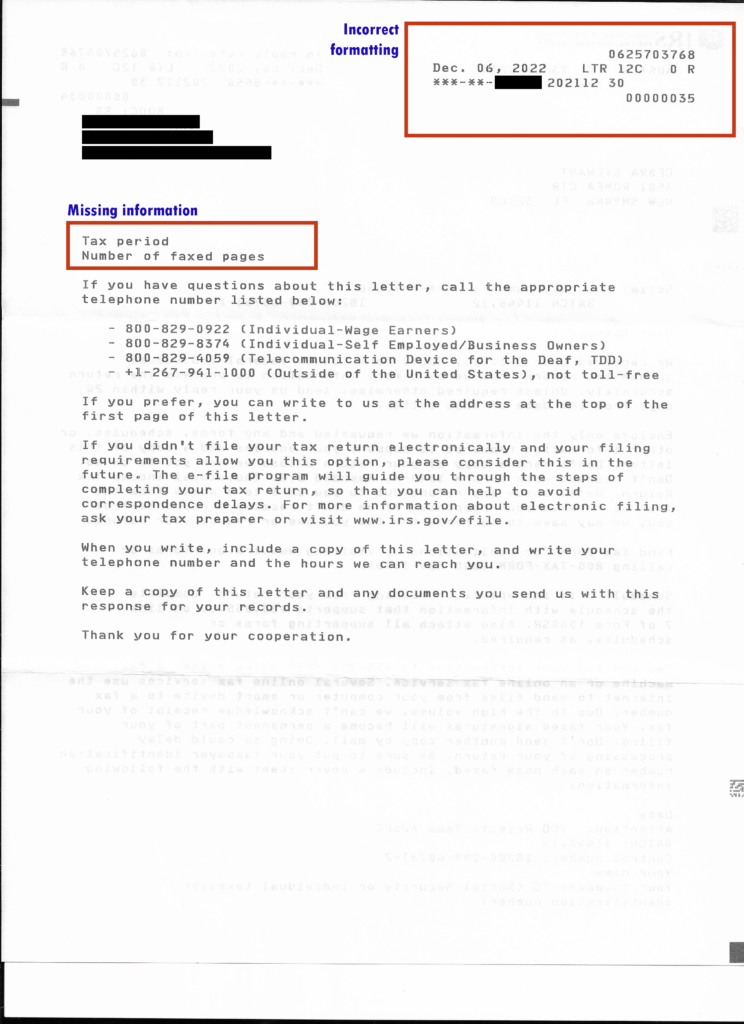

- The IRS never refers to a tax return or tax year as a full date (ex. Dec 31, 2021). They always refer to a tax period by year only (ex., 2021)

If you have called a phone number from a fraudulent IRS letter and provided any personal information (social security numbers, home address, bank information, etc.), you should immediately complete an IRS Form 14039 Identity Theft Affidavit and submit to the IRS. This will allow the IRS to flag your tax accounts so if there are any fraudulent activities on future tax returns or tax returns you have already filed, you can easily make corrections and prevent incorrect penalties from being applied to your accounts. You will also want to apply for an IRS Identity Theft PIN number which will be required to be included on all future tax returns you file.

The IRS also has valuable information for identifying and avoiding scams in this help article: “Avoid scams: Know the facts on how the IRS contacts taxpayers“

For your reference I have included a legitimate letter from the IRS and some examples of actual fraudulent letters my clients have received. Please use these as a reference anytime you receive a letter regarding your taxes. Finally, please reach out to me anytime you receive a letter from the IRS or any State agency regarding your taxes.

SAMPLE: CORRECT IRS LETTER

SAMPLE: FRAUDAULENT IRS LETTER

SAMPLE: FRAUDAULENT IRS LETTER

SAMPLE: FRAUDAULENT IRS LETTER