Standard Deduction and Personal Exemption

Standard deductions increase slightly for 2022 as follows:

Single = $12,950

Married Filing Joint = $25,900

Head of Household = $19,400

Child Tax Credit

The 2022 child tax credit reverts back to pre-2021 rules. The credits for 2022 are as follows (subject to AGI limitations):

$2,000 for each child under the age of 17 (17 year old children are not eligible for the credit in 2022)

Medical Expense Deduction

The AGI threshold for 2022 remains at 7.5%. Therefore, any out of pocket medical expenses you incur above 7.5% of your AGI (and you exceed the standard deduction amount) can be deducted. You must be able to itemize deductions to qualify.

Charitable Contributions

The 60%-of-AGI limit on deductions for CASH donations by individuals who itemize is in effect for 2022. You must itemize on Schedule A and does not include excess charitable contributions from prior years.

Capital Gains

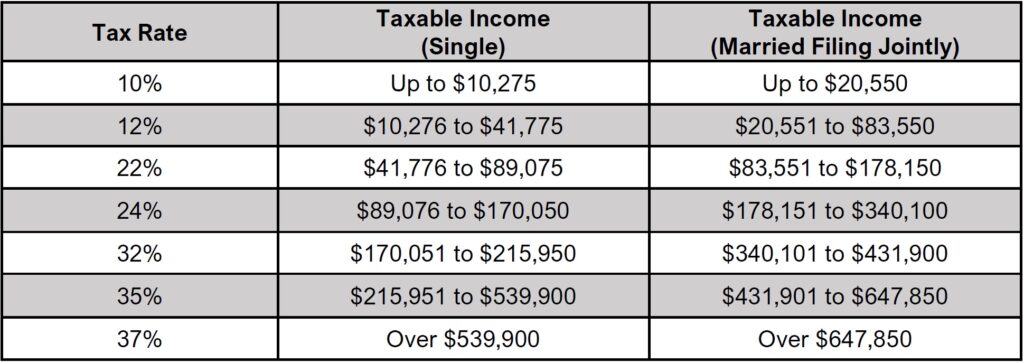

1. Short-term capital gains are still taxed as ordinary income for investments held less than one year and ordinary dividends. Since the tax brackets applied to ordinary income since 2018 have changed significantly, your short-term gains are likely taxed at a different rate than they formerly were.

2. Long-term capital gains tax rates rates remain the same (0%, 15% or 20%) depending on filing status and income level. Income thresholds for each rate increase slightly for 2022.

3. The 3.8% net investment income tax rate (Medicare surtax) that applied to high earners remains the same.

Businesses

1. Business meals for 2022 remain 100% deductible to encourage restaurant dining. This includes client meals as well as meals for employees on business travel. The deduction will return to 50% in 2023.

2. Pass through companies (S-Corporations, Partnerships, LLCs and sole proprietors) still receive a 20% deduction of qualified business income. The taxable income limitation thresholds increase in 2022 ($340,100 married/$170,050 single). This deduction is complex and does have certain restrictions for service-type companies (law, accounting, health and financial services), so please contact me if you have specific questions.

3. 100% Bonus Depreciation for the purchase of certain assets that are put into use during the tax year. This deduction is temporary and will last until the end of 2022.

4. Business mileage rates for 2022 has been split between the first 6 months of the year and second 6 months of the year. Jan 1 – June 30, 2022 = $0.585 per mile, July 1 – Dec 31, 2022 = $0.625 per mile

5. The C-Corporation tax rate remains at a flat 21%.

There are many more small changes to both business and individual taxes, but this blog was intended to educate you on the major changes that effect the majority of taxpayers. If you have any specific examples or items you would like to discuss, please contact me!