Standard Deduction and Personal Exemption

Standard deductions increase slightly for 2024 as follows:

Single = $14,600

Married Filing Joint = $29,200

Head of Household = $21,900

Child Tax Credit

The credit for 2024 is as follows (subject to AGI limitations):

$2,000 for each child under the age of 17 (17 year old children are not eligible for the credit in 2024)

Medical Expense Deduction

The AGI threshold for 2024 remains at 7.5%. Therefore, any out of pocket medical expenses you incur above 7.5% of your AGI (and you exceed the standard deduction amount) can be deducted. You must be able to itemize deductions to qualify.

Charitable Contributions

The 60%-of-AGI limit on deductions for CASH donations by individuals who itemize is in effect for 2024. You must itemize on Schedule A and does not include excess charitable contributions from prior years.

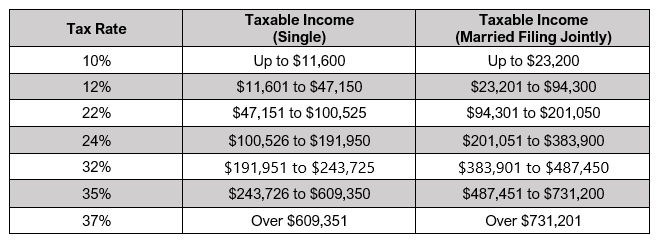

Capital Gains

1. Short-term capital gains are still taxed as ordinary income for investments held less than one year.

2. Long-term capital gains tax rates rates remain the same (0%, 15% or 20%) depending on filing status and income level. Income thresholds for each rate increase slightly for 2024.

3. The 3.8% net investment income tax rate (Medicare surtax) that applied to high earners remains the same.

Businesses

1. Business meals for 2024 remain 50% deductible. This includes client meals as well as meals for employees on business travel.

2. Pass through companies (S-Corporations, Partnerships, LLCs and sole proprietors) still receive a 20% deduction of qualified business income. The taxable income limitation thresholds increase in 2024 ($383,900 married/$191,950 single). This deduction is complex and does have certain restrictions for service-type companies (law, accounting, health and financial services), so please contact me if you have specific questions.

3. 60% Bonus Depreciation for the purchase of certain assets that are put into use during the 2024 tax year. This deduction will decrease to 40% in 2025.

4. Business mileage rate for 2024 is $0.67 per mile.

5. The C-Corporation tax rate remains at a flat 21%.

There are many more small changes to both business and individual taxes, but this blog was intended to educate you on the major changes that effect the majority of taxpayers. If you have any specific examples or items you would like to discuss, please contact me!